Low Business Costs

Missouri Corporate Tax & Low Business Costs

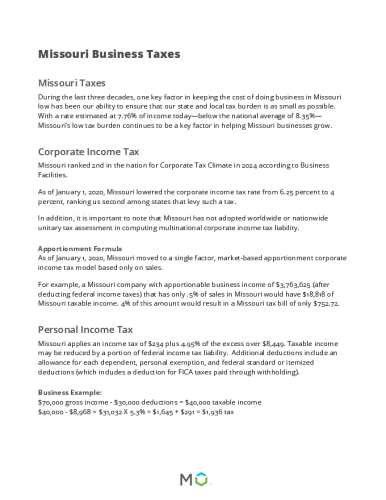

In Missouri, corporate taxes and business costs won’t drain all of your company’s profits. By lowering your operation costs, Missouri provides a solid foundation for your company to expand and flourish.

Missouri’s corporate income tax rate is 4%, making it one of the most tax-friendly states in the country. With only income earned in Missouri being taxed, you’ll receive a critical advantage for your business.

Missouri also has a single-factor, market-based corporate income tax apportionment model based only on sales. It’s important to note that Missouri has not adopted worldwide or nationwide unitary tax assessment in computing multinational corporate income tax liability.

Low Taxes & Costs Make Missouri Ideal for Business Growth

Missouri helps companies make their operations more cost-effective and competitive. Businesses operating in Missouri enjoy benefits such as:

- Reliable and inexpensive energy

- Aggressive and performance-based incentives

- Statewide commitment to attracting companies and investment

- Customized training programs through Missouri One Start

- Low taxes, business, and labor costs

Talk to our team to find out how we can assist you in improving your profitability and lowering your business costs.

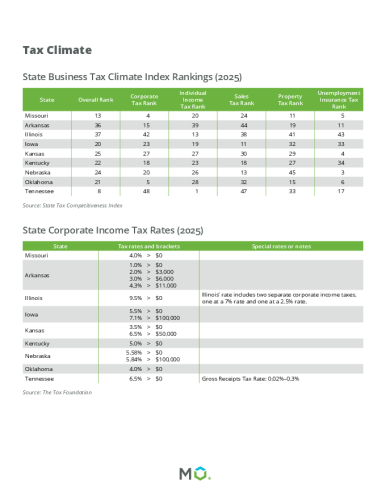

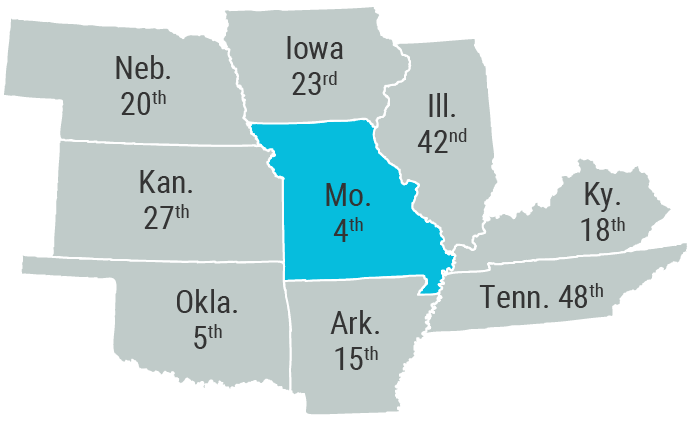

One of the Lowest Corporate Tax Rate States

- 4th-best corporate income tax index in the U.S. (Tax Foundation)

- 5th-best unemployment insurance tax index in the U.S. (Tax Foundation)

- 11th-best property tax index in the U.S. (Tax Foundation)

- A better corporate tax climate than most surrounding states, including Arkansas, Kansas, Illinois, Iowa, and Oklahoma (Tax Foundation)

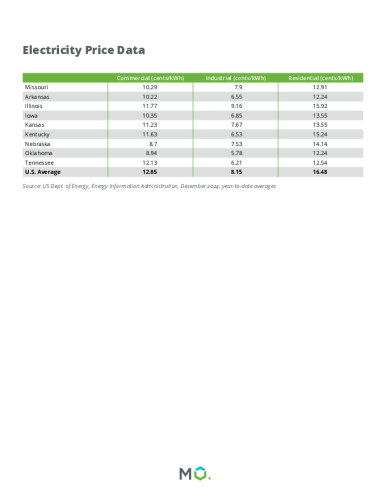

Competitive Energy Costs

Keep your operating costs at a minimum. With a low, predictable monthly bill, you’ll be able to budget more accurately and effectively.

- Commercial electricity costs are 25% lower than the U.S. average, at 10.29 cents/kWh (EIA, 2024)

- Residential electricity costs are 24% lower than the U.S. average, at 12.91 cents/kWh (EIA, 2024)

Specifics on Missouri Taxes

- Personal income tax: $256 plus 4.70% of excess over $9,191

- Property tax: Commercial and industrial property assessed at 32%; personal property at 33 1/3%.

- Business inventories are not taxed. Tax rates are the aggregate of local taxing districts and a .03 state tax.

- State sales and use tax: 4.225%

- Unemployment insurance taxable wage base: $9,500

- Unemployment insurance new employer entry rate: 2.376%

Missouri Economy

Missouri offers a stable and thriving economy for businesses and individuals alike. The state’s strong credit ratings, disciplined fiscal management, and commitment to balancing budgets ensure a reliable financial landscape.

Additionally, Missouri’s diverse financial ecosystem supports both large corporations and small businesses, providing access to capital, investment opportunities, and financial services that drive economic growth across the state